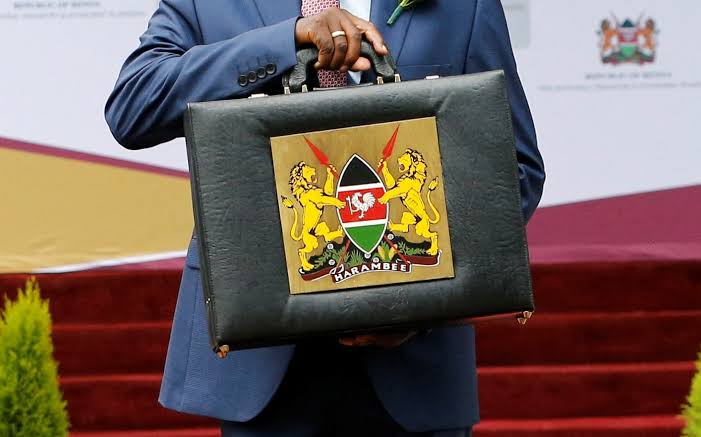

The 2025/26 financial budget is now public. But let’s be honest – not everyone is lining up to read a 300-page document full of jargon.

So, I’ve attempted to break it down to the bits that have boosted the Kenyan youth – and, the parts that have them in a choke hold.

1. A New, Better Youth Fund

The government is planning to scrap the old Youth Enterprise Development Fund and replace it with a better version – one that will offer loans, grants, and business training for youth.

So, if you’ve got an idea, you might just get funded… if this fund goes live soon.

2. NYS to Recruit 40,000 Youth

If you’re looking for skills, discipline, or even a structured income opportunity, the National Youth Service (NYS) is targeting 40,000 new recruits this year.

That means vocational training and possible deployment in various government projects.

3. Education is Feeling the Pinch

Over 900,000 students in secondary school are at risk as funding for free education faces a Sh43 billion hole.

The school feeding program too? Underfunded. So, while education remains a priority, the struggle is real.

4. Digital Hubs

Despite the cuts, 274 digital hubs are already up and running. Over 500,000 youth have received training, and some are already earning online.

The internet might not solve everything – but it can still help pay some bills.

5. NYOTA & WHOZNEXT: New Opportunities

These new programs want to connect youth with jobs, mentorship, and talent growth.

Think of them as modern ways to showcase what you can do – whether it’s coding, content creation, or your side hustle. Eyes open on these.

6. Cheaper Smart Phones Locally Assembled

You don’t need to break the bank for a smartphone anymore.

Locally assembled, smart-enabled phones will now retail at Sh7,500. That means more youth can access the internet, digital work, and apps that actually pay.

7. Focus on the Creative Economy

The government says it wants to promote the arts, music, fashion, and everything creative — but again, funding is a bit tight. Programs like “Vijana Vuka na Afya” are struggling to stay afloat. But the intention is there, and that’s still worth watching.

8. Digital Jobs Programs Face Budget Cuts (Yes, Really)

The Ajira Digital and Jitume Hub programs – the ones meant to help you earn online – have been hit by serious funding cuts.

That means fewer training slots and fewer digital job opportunities. If you were planning to hop onto online work via government-supported platforms, this might slow you down.

So, In a Nutshell ….

The 2025/26 budget is trying to balance a tough economy with big dreams – especially for the youth.

Yes, there are challenges (cuts here, shortfalls there), but the doors aren’t shut.

Whether it’s hustling online, joining NYS, or pitching that business idea, there’s still room to play your part.

Stay woke. Stay ready. Your next opportunity might just be one budget item away.