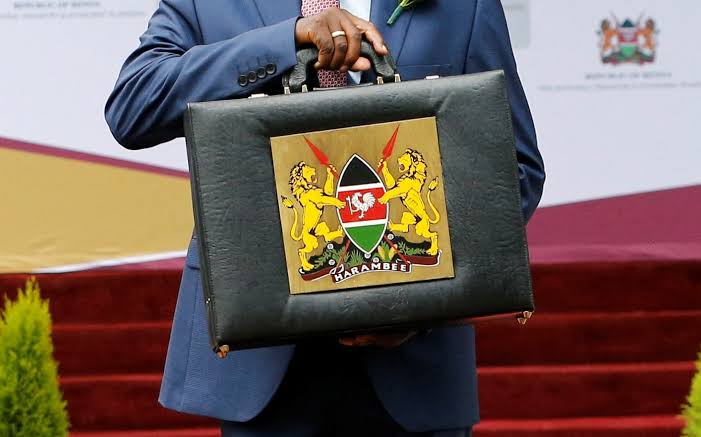

For a country that has long debated taxation in hushed tones and treated national budgets as the preserve of economists and technocrats, the 2025/26 Finance Bill marks a radical shift in tone, ownership and ambition.

What was once seen as a dry legislative ritual has become a national conversation – passionate, messy, democratic, and long overdue.

What does this Budget actually say?

No New Personal Income Taxes – Only Smart Adjustments

Forget the doomsday headlines. The 2025 Finance Bill does not introduce new taxes on your salary or personal income.

Instead, it proposes strategic tax reforms that widen the tax base, seal evasion loopholes, and provide more incentives for compliance.

Because here’s the truth: Taxation is not punishment – it’s a tool for nation-building.

From education to healthcare, from roads to reliable electricity, every coin collected is an investment in a Kenya that works for all.

Under the Bottom-Up Economic Transformation Agenda (BETA), this Government is intentionally directing tax revenue toward projects that impact lives at the grassroots.

Raising Domestic Revenue

It’s a simple equation: if we are serious about reducing debt, we must increase what we collect internally. Kenya cannot continue borrowing to build classrooms, pay doctors, or repair roads.

Through the BETA lens, taxation isn’t just about plugging budget deficits – it’s about empowering communities, growing MSMEs, supporting the vulnerable, and funding transformative programs like Affordable Housing and Universal Healthcare.

Budget Saboteurs Are Hoping You Don’t Understand the Numbers

A few loud voices have tried to delegitimize the entire budget process – ironically, many of them fully understand how it works.

They know that governments all over the world use budgets to implement policy and fund promises. But rather than educate the public, they prefer to stir mistrust and anger.

This administration was elected to deliver on a clear vision, anchored in BETA. Undermining the process is not just unfair – it weakens democratic tradition and distracts from the work at hand.

Major Sector Wins On the Ground

So what does this year’s budget deliver

Infrastructure & Transport Ksh 318B for road construction, rural electrification, digital connectivity Better roads, faster transport, electricity in rural homes, more access to digital jobs.

Education Ksh 700B – the highest sector allocation More students enrolled through free basic education, more support for TVETs and universities.

Healthcare (especially Cancer Care) Massive investment in radiotherapy machines, regional hospitals, and UHC rollout Faster diagnosis, affordable cancer treatment, and a working “Taifa Care” system.

MSME Support Enhanced incentives and access to funds for traders and small business owners Stronger local economies, youth employment, financial independence at the grassroots

These aren’t theories.

Homes are being built and allocated. Hospital services are improving. Wi-Fi is being rolled out to markets and rural spaces.

We’re Not Just Funding Government – We’re Funding Ourselves

The Finance Bill 2025 is more than a policy framework. It is a pact – between the citizen and the state – to prioritize Kenya’s future.

It’s about creating a functional, inclusive economy that works for the majority, not just the few.

So the next time you hear the word “budget,” don’t switch off. Engage. Understand. Question.

And yes – own it.

Because this time, it really is yours.