Do you have a kindergartner in your house? Parental protocols demand that at some point, homework sessions shall take up a section of your evening. Hey, those booklets have a blank space for the parent’s signature!

Have you tried teaching the new phonetic alphabet?

Let me tell you, Maina. It’s easier for the proverbial rich man to squeeze through the eye of a needle.

The new phonetic alphabet is messing up that innate, regal awe kids have for their parents. Suddenly, daddy is no longer fit for the Superman cape – he doesn’t have a clue of basic ABC’s!

The new phonetic alphabet is messing up that innate, regal awe kids have for their parents. Suddenly, daddy is no longer fit for the Superman cape – he doesn’t have a clue of basic ABC’s!

So, heads up to new dads whose kids are joining school, in May. Brace for a few evenings, which will have you looking like a total fool in the eyes of your kid. As it is, day one in school stamps the teacher as an all-knowing deity, so anything you teach your kid has to measure up.

You schooled in the archaic A – for apple, B – for boy days. Your kid will smirk with glee for catching you wrong for the first time. “No! Teacher didn’t say that!”

They’ll scream at you. In their eyes, you can read ‘What a blithering idiot’ in a billboard size font.

Ah, Buh, Cuh, Du, Fff……

At this point, you’ll call for your house manager. In that household, she’s the closest to solving this riddle. You’d better pray she can scribble a ‘parental’ signature on that homework booklet.

At the end of the first week, your kindergartner shall bring home their weekend CBC project. They are supposed to make a scarecrow.

Teacher Ann, really? What happened to simple dolls or basic game boards for projects?

You have seen scarecrows in millet farms swaying in the breeze on occasional drives out of town. But, you’ve never taken a moment to think of what it takes to make one. Do you nail rods together, and then dress that frame in old clothes?

Ah, well, let’s search online. The requirements and tools needed guarantee a rather hectic weekend ahead.

What never subsides even for a moment, is your kid’s energy. At 0400hrs, Saturday morning – kid is tagging at the foot of your bed.

“Daddy, let’s go make scarecrow. Teacher Ann said you help me!” You’ll groan and turn, but it is what it is.

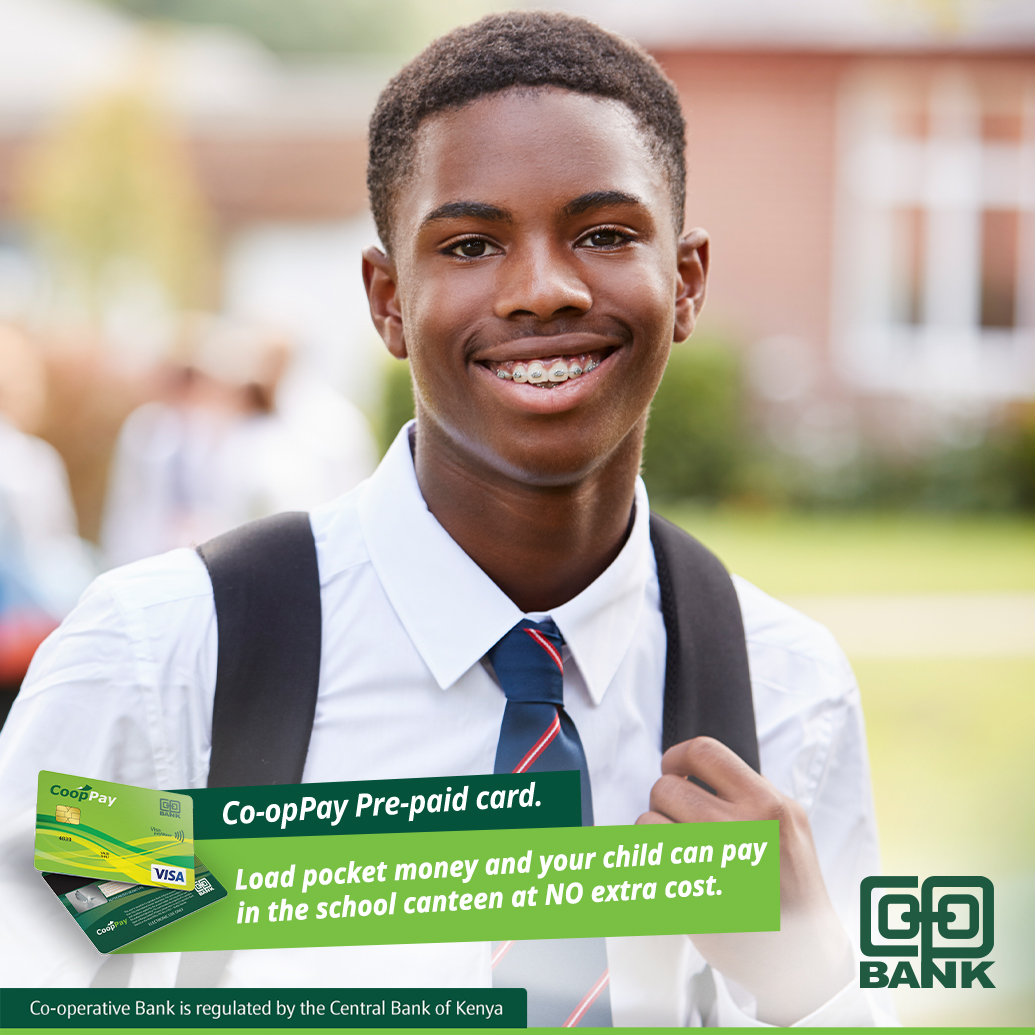

Well, as new parents prepare for their kid’s first day in school there’s a lot of businesses that make it easy. They provide basic requirements. There’s need for several pairs of uniforms in the school’s specifications. A need several pairs of shoes – it’s not uncommon for a new scholar to return home without a shoe – or different shoes. New parent, prepare mentally for such an occurrence.

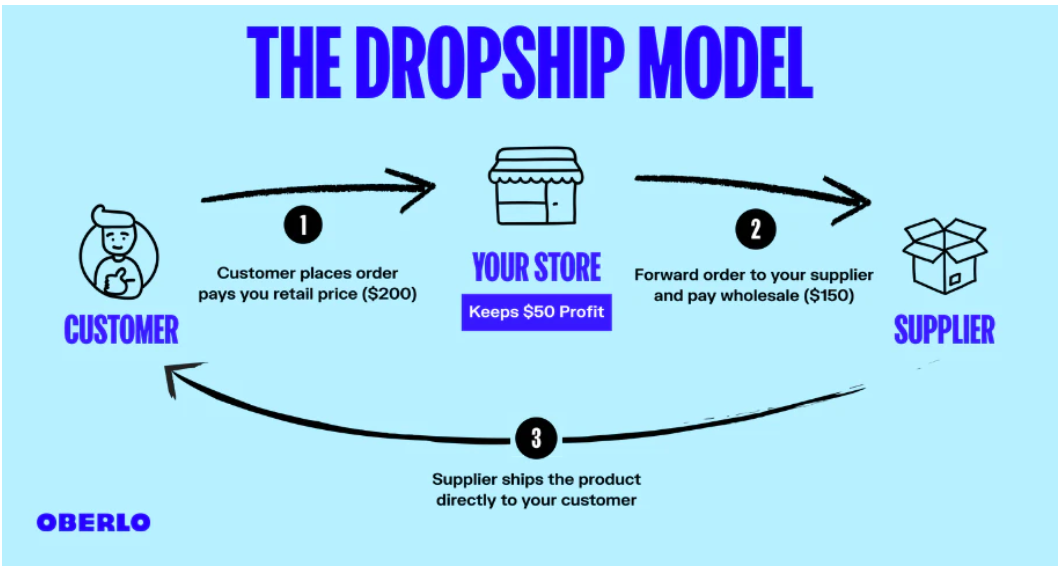

For business owners, it’s easy to cash in on this flurry of purchases by accepting online card payments via Chapa Pay, Co-op Bank’s eCommerce solution.

Chapa Pay eCommerce solution allows you to receive online card payments from your customers directly into your Co-op Bank account. The best part is that a business does not need to have a website to receive online card payments. In this case, the business owner receives a unique link (Pay-By-Link) which is used to invoice their customers.

It attracts no extra costs and it’s very secure. To learn more ways to build your business with Chapa Pay, click here. Alternatively, walk into the nearest Co-op Bank branch and speak to a bank representative.

This is the first step to joining the best financial partner for hassle-free business growth, and going global.